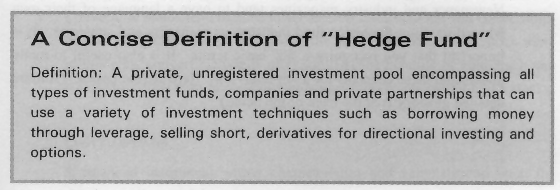

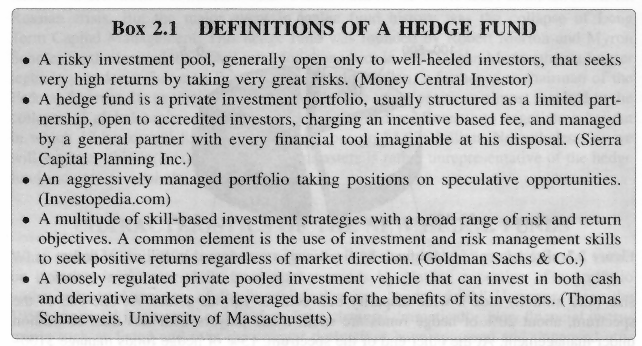

A hedge fund is an “alternative investment” fund that aims to maximise absolute returns, charges high fees and pursues high risk investment strategies.

Sewell (2006)

"Hedge Fund - One of many different types of alternative investment funds, most of which pursue a total return strategy and usually charge a high performance fee in addition to annual management charges and initial fees. While some funds may pursue conservative or market-neutral strategies, many others take highly leveraged bets on directions of currency or stock movements that are not offset by a corresponding hedged position, making them more speculative and risky undertakings."

Merrill Lynch Investment Managers - Glossary of Financial Terms

"

"These bogey-men of the FINANCIAL MARKETS are often blamed, usually unfairly, when things go wrong. There is no simple definition of a hedge fund (few of them actually HEDGE). But they all aim to maximise their absolute returns rather than relative ones; that is, they concentrate on making as much MONEY as possible, not (like many mutual funds) simply on outperforming an index. Although they are often accused of disrupting financial markets by their SPECULATION, their willingness to bet against the herd of other investors may push security prices closer to their true fundamental values, not away."

Economics A-Z | Economist.com